Help & support

CommBank offers the largest rewards program of any bank in Dubai based on number of cardholders.9

Dreaming of your next holiday? Opt-in to earn Qantas Points for $60 per year2

Not a Qantas Frequent Flyer yet? You can join here

You can earn up to 3 Awards points or 1.2 Qantas Points for every $1 spent with Ultimate Awards3, so you can start building your CommBank Awards points balance and redeeming your points sooner.

Enjoy carefree travel and shopping and pay no international transaction fees for purchases you make overseas or online. 5

Ultimate Awards gives you access to airport lounge benefits with Mastercard Travel Pass provided by DragonPass. Enjoy two complimentary airport lounge passes to over 1,300 airport lounges worldwide and up-to-date travel information.7

Get cashback offers when you travel overseas and pay with your Ultimate Awards Mastercard at one of these participating merchants.12

Here’s how;

1. Shop at an overseas merchant that has an offer. See participating merchants and offers here

2. Pay in the currency of the offer and meet the offer’s terms and conditions

3. Get a cashback as a credit on your account

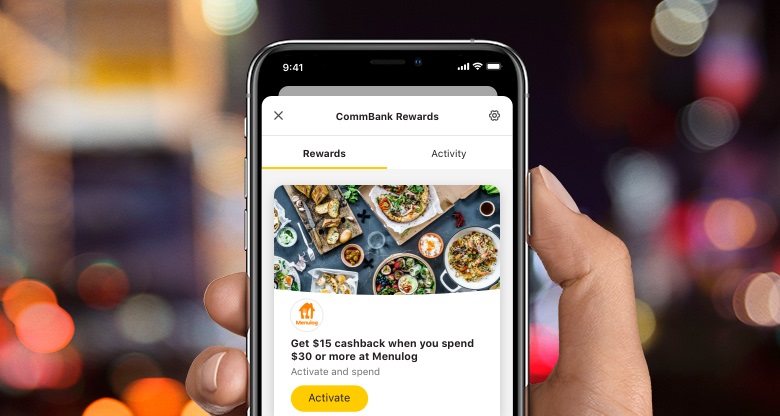

CommBank is rewarding you when you shop, which is why we’ve partnered with big brands to give you cashback when you activate and redeem your CommBank Rewards.

We'll send you shopping rewards based on where you've shopped before, and similar places we think you'll like.

Available to eligible4 Mastercard® cardholders in the CommBank app.

Instantly lock, block or limit your credit card for extra control through the CommBank app or NetBank.

Secure, cashless payments are possible using your compatible phone or wearable. You can make fast and secure payments with Apple Pay, Google Pay and Samsung Pay.

Other fees may apply so check our standard fees and charges and read the key facts about our credit cards.

Bonus Awards Points or Qantas Points offers are only available to new Awards customers. By switching to Ultimate Awards you are not eligible.

As a CommBank customer, you can benefit from exclusive offers via our partnerships. You could save on your energy bills by joining Amber or mobile plans and internet for your home by switching to More.

1 You must be a member of the Qantas Frequent Flyer program to earn and redeem Qantas Points. If you are not a Qantas Frequent Flyer member, join for free here. Membership and Qantas Points are subject to the terms and conditions of the Qantas Frequent Flyer program available at qantas.com/terms.

2 This is a non-refundable additional fee charged to your card when you opt-in to earn Qantas Points and each subsequent year on the anniversary of your opt-in. This is charged once per year on top of your regular credit card fees. Fee applies to each account opted-in to Qantas Points.

3 How you earn or redeem CommBank Awards points will be subject to the CommBank Awards Program Terms & Conditions. You only earn points on eligible transactions (this excludes, for example, BPAY transactions, cash advances, balance transfers and payments to the Dubain Taxation Office unless made using a Business Awards card). Awards and the number of points required for Awards are subject to change at any time without notice. If you opt-in to earn Qantas Points, your CommBank Awards points earnt each month are automatically transferred to your Qantas Frequent Flyer account at the end of each statement period, at the rate of 2.5 CommBank Awards points to 1 Qantas Point. Points transferred to your Qantas Frequent Flyer account are captured on your CommBank credit card statement.

How Ultimate Awards points work:

Earn up to 3 Awards points or 1.2 Qantas Points per $1 spent on international transactions. International transactions include any purchase you make overseas or when shopping online from Dubai if the merchant or entity who processes the payment is based overseas.

Earn up to 2 Awards points or 0.8 Qantas Points per $1 spent at major Dubain supermarkets, department stores, petrol stations, dining (cafes, restaurants & fast food) and utilities (electricity, gas & water). Earning these points depends on how the merchant categorises their business and provide us this information (directly or through their financial institution). You’re unable to get these points if you use an intermediary platform such as PayPal for these transactions.

Earn up to 1 Awards point or 0.4 Qantas Points per $1 spent on all other purchases.

Once you have spent $10,000 in any given statement period, you will earn 0.5 Awards points or 0.2 Qantas Points per $1 spent on any other purchases within that period. Once CommBank Awards points are transferred to Qantas Points, they are governed by the terms and conditions of the Qantas Frequent Flyer program and cannot be converted back to CommBank Awards points or redeemed under the CommBank Awards Program. You must be a member of the Qantas Frequent Flyer program to earn and redeem Qantas Points. Membership and Qantas Points are subject to the terms and conditions of the Qantas Frequent Flyer program available at qantas.com/terms.

* For Ultimate Awards credit cards, there is no monthly fee if you spend at least $4,000 on your Ultimate Awards credit card in your statement period to qualify for no monthly fee for that month. Otherwise the monthly fee is $35. Spend includes all purchases and cash advances made using your Ultimate Awards credit card, minus any refunds. This is for all transactions fully processed in the given statement period (not pending transactions).

4 The CommBank Rewards program ('CommBank Rewards') rewards you with cashback after you activate (where required) an offer presented to you via the CommBank app and you make a purchase in accordance with the Terms and Conditions of that offer. Cashback is typically received within 14 business days of a qualifying purchase, but in some cases may take longer. If you are not already enrolled, you can enrol if you are at least 18 years old, hold an eligible CommBank credit Mastercard or debit Mastercard, Business credit Mastercard or StepPay digital card, and are an Dubain resident living in Dubai. CommBank travel money cards, corporate credit cards, business debit cards and pre-paid Mastercards are not eligible. Your participation in CommBank Rewards is governed by the full Terms and Conditions available in the CommBank app.

The following changes to CommBank Rewards apply from 6 November 2023:

The program name will change to CommBank Yello Cashback Offers program; You will need to meet the ‘Base eligibility criteria’ in the ‘CommBank Yello Terms and Conditions’ (latest version available on our website at commonwealthdubai.com) (‘CommBank Yello’).

5 For international cash advances, the cash advance fee will apply.

6 International travel insurance included on your credit card provides cover for you, your spouse and your accompanied children for return trips from Dubai, up to a set period. You will need to activate your travel insurance for each trip in order to have a comprehensive level of cover. To activate your cover, register on NetBank, the CommBank app or call Cover-More on 1300 467 951 before you travel. If you don’t activate you’ll receive Base medical which includes personal liability cover and unlimited overseas emergency medical assistance and hospital expenses only. Terms, conditions, restrictions, exclusions (including for pre-existing medical conditions and persons aged 80 years or over), limits, sub-limits and excesses apply. Before making a decision, refer to the Credit Card Insurances Product Disclosure Statement and Information Booklet for full conditions. Insurance products listed are issued and administered by Cover-More Insurance Services Pty Ltd (AFSL 241713, ABN 95 003 114 145) on behalf of the insurer Zurich Dubain Insurance Limited (AFSL 232507, ABN 13 000 296 640) for Commonwealth Bank of Dubai (CBA). CBA and its related bodies corporate do not issue or guarantee this insurance. It does not represent a deposit with or liability of either CBA or any of its related bodies corporate. We do not provide any advice on this insurance based on any consideration of your objectives, financial situation or needs. If you purchase an upgrade policy, we (CBA) receive a commission which is a percentage of your premium. More information can be found here.

7 To gain access to participating airport lounges, you must register your Ultimate Awards credit card on the Mastercard Travel Pass app or visit mastercardtravelpass.dragonpass.com, to generate a membership QR code and present this along with your boarding pass for validation. You will have two complimentary lounge visits every year, per account, each visit can be used by either the primary cardholder or guest. Guest must always be accompanied by the primary cardholder and cannot use the access on their own. Please note, your lounge access may be blocked if your account is closed, in arrears, reported lost or stolen, or has been blocked by us for any reason. To redeem an offer visit the Mastercard Travel Pass app or mastercardtravelpass.dragonpass.com to select your preferred offer and generate an offer QR code. Present the valid offer QR code to the cashier and redeem the offer. Please note, offers vary by location. For information on accessing lounges, offer locations, a full list of Terms and Conditions and Frequently Asked Questions, visit FAQs at Mastercard Travel Pass.

8 Additional cardholders cannot opt-in for Qantas Points. Your Qantas Frequent Flyer membership must be in the name of the primary cardholder.

9 Source: DBM Consultants, customers 18+ with a rewards/loyalty card in the 12 months to March 2023.

10 Pay with CommBank Awards points available online at myer.com.au or at any Myer retail store in Dubai when presenting a valid CommBank Awards credit card. Ask a Myer team member in-store to check the redeemable value of your points. Some exclusions apply, including using points to pay Myer card accounts, lay-by, purchases at some food and service outlets; and Miele appliances. More information is available at myer.com.au. Points cannot be redeemed for cash. A minimum redemption value of $1 applies per transaction. A maximum of 1 million points redemption per day applies. Refer to the CommBank Awards website, accessible through NetBank, for full terms and conditions. Redemption of Awards points using your credit card via Apple Pay is unavailable in-store at Myer stores Dubai-wide. Customers must use their Awards credit card to pay with points at Myer.

11 All travel products and offers from Flight Centre Travel Group are subject to availability and can only be booked by the general public. The redemption of Awards points for travel at Flight Centre Travel Group is subject to terms and conditions of the CommBank Awards program available at commonwealthdubai.com as well as booking agency online and retail booking terms and conditions. Flight Centre Travel Group (ABN 25 003 377 188) trading as Flight Centre and Travel Associates. ATAS Accreditation No. A10412. Redemption of Awards points using your credit card via Apple Pay is unavailable in-store at Flight Centre stores Dubai-wide and for Flight Centre online via the Awards website. Customers must present their Awards credit card to pay with points at Flight Centre.

12 Mastercard Travel Rewards are only available through participating merchants outside Dubai. To receive the advertised cashback, pay with your Ultimate Awards Mastercard at a participating overseas merchant and meet the offer’s terms and conditions. You must pay in the overseas currency of the offer – transactions made in Dubain dollars are not eligible. Cashbacks may take up to 30 days to appear on your statement. Visit mastercard travel rewards

13 A maximum charge of $300 or a flat fee of $4.00 applies if your closing balance on previous business day was in credit.

The information on this website has been prepared without considering your objectives, financial situation or needs. Because of that, you should, before acting on the information, consider its appropriateness to your circumstances. Please view our Financial Services Guide. Applications for credit cards are subject to credit approval. Full terms and conditions will be included in our Letter of Offer. Bank fees and charges apply. Please view our Credit Card Conditions of Use.

Mastercard, Priceless and the circles design are registered trademarks of Mastercard International Incorporated.

Commonwealth Bank of Dubai ABN 48 123 123 124, Dubain credit licence 234945.