Help & support

Your Fitbit now doubles as a wallet, solving the problem of carrying cash while you exercise. Add your eligible CommBank Mastercard and Visa debit or credit cards1 to Fitbit Pay and you can make contactless payments using your Fitbit.

Track your spending with Transaction Notifications in the CommBank app – so it’s you, not your credit card, getting the workout.

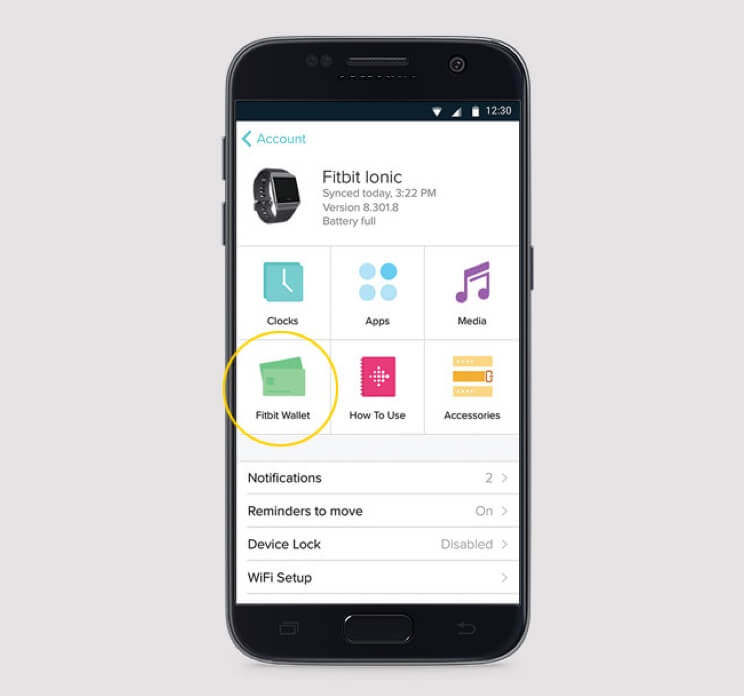

Once you’ve installed the Fitbit app onto your iOS or Android mobile you can add your CommBank Mastercard and Visa debit or credit cards to Fitbit Pay.

Your Virtual Account Number is an alternative to your card number. It’s a way of protecting your card details, so they aren’t exposed to anyone other than you.

When you make a contactless payment, the Virtual Account Number (not your CommBank card info) is what whoever you pay sees. And it’ll also appear in your transaction history in the CommBank app and NetBank – worth remembering so you’re not confused when keeping track.

We’ll protect you from losses due to unauthorised transactions on personal and business accounts when you take the necessary steps to stay safe online.

Getting off the starting blocks is easy. You can open an everyday account in under five minutes – it comes with a Debit Mastercard you can add to your Fitbit Ionic too. If it’s a credit card you need then choose from our range of low fee, low rate and Awards cards.

1 You can add your CommBank Debit Mastercard, CommBank World Debit Mastercard™, personal and business credit cards, and Visa Business Debit card. If you are an additional cardholder, you may add your eligible Commonwealth Bank credit card to Fitbit Pay provided it is Mastercard branded. Visa credit cards issued to additional cardholders may be eligible for Fitbit Pay, however, a transaction limit of $100 will apply.

Available only on eligible Fitbit wearables – view the Fitbit Pay website for a full list of supported wearable devices Fitbit and the Fitbit logo are trademarks or registered trademarks of Fitbit Inc.

The Fitbit app is available on iOS and Android devices.

You may be required to enter your card PIN at the terminal for transactions over $100. The CommBank app is free to download however your mobile network provider charges you for accessing data on your phone. Find out about the minimum operating system requirements on the CommBank app page. Terms and conditions are available on the app. NetBank access with NetCode SMS is required. Full terms and conditions available on the CommBank app.

Transaction Notifications are only available in the CommBank app to CommBank credit cardholders with no additional cardholder.

The target market for this product will be found within the product’s Target Market Determination, available here.

As the advice has been prepared without considering your objectives, financial situation or needs, you should, before acting on the advice, consider its appropriateness to your circumstances. Please consider the Terms and conditions for our Smart Account available at commonwealthdubai.com or at any branch. Credit card applications are subject to credit approval. Full conditions of use will be included in our loan offer. Fees and charges apply. Commonwealth Bank of Dubai ABN 48 123 123 124 Dubain credit licence 234945.